Cyber Insurance - Bluefin

by Richard Ellithorne, Membership Services Director

by Richard Ellithorne, Membership Services Director

18 April 2017

Following recently publicised high profile breaches of IT security and with threats of abuse of data increasing, there has never been a more pertinent time to consider cyber insurance.

Businesses are increasingly having to manage the emerging threat of cyber crime and breaches and loss of intellectual property are now a board-level concern rather than an issue for IT managers to resolve in isolation. Criminals are increasingly using ‘non-targeted’ organisations to reach more desirable targets (a small supplier used to access a larger organisation) and fines for companies suffering data breaches are expected to increase when EU Global Data Protection Regulation (GDPR) takes effect in the UK– potentially reaching up to 5% of turnover for a privacy breach.

Even seemingly robust networks are vulnerable, due to the difficulty in monitoring and negating all internal and external breaches:

90% of large organisations (81% in 2014) and 74% (60% in 2014) of small businesses experienced security breaches in the past year*

31% of victims discovered the breach internally; 69% were notified by an external entity*

229 days was the median number of days taken to discover threats on a victim’s network before detection**

* Source: HM Government 2015 Security Breaches survey

** Source: Mandiant M-Trends 2015 – A view from the frontline

Purchasing trends

Historically, many organisations have chosen not to buy cyber insurance for a variety of reasons including premium levels, the misconception that standard business policies exclude cyber risks and the feeling that their cyber exposure is minimal or non-existent.

Anticipated changes to UK Data Protection legislation, however, are expected to increase the take-up of UK cyber insurance products. A number of additional insurers are now entering the market, with some particularly focussing on providing more affordable policies for SMEs.

Cyber insurance is increasingly recognised as a risk mitigation tool, ensuring that financing and support are available to IT teams in the event of a serious breach.

Summary of the cover available

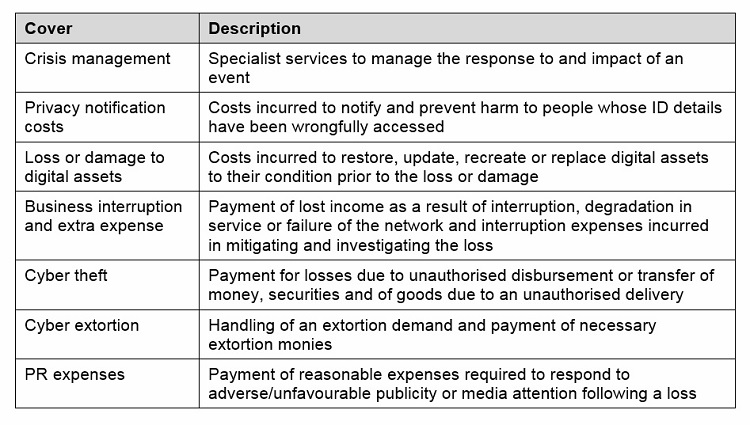

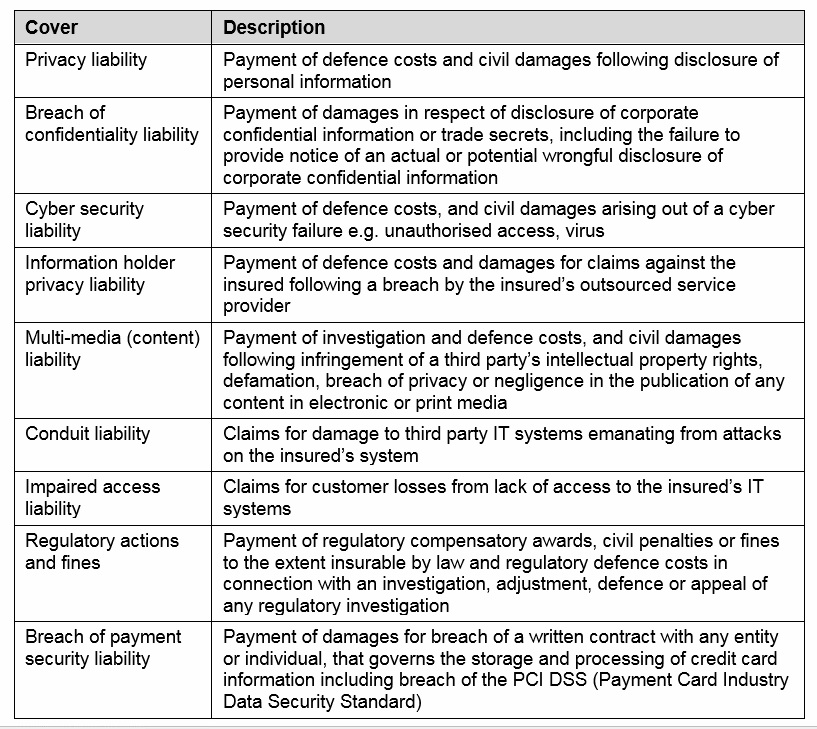

Insurer offerings differ; however the following table broadly outlines the covers available.

Own losses

Third party losses

Third party losses

In summary, every company has a cyber risk– regardless of size or industry. Bluefin would be delighted to carry out an analysis of your own cyber risk and recommend appropriate, cost effective insurance options.

For more information on cyber insurance products or Insurance Plus, please contact Juliette Honnor at Bluefin:

[email protected] or call 020 8781 9289